13795 ANDORRA DR, WOODBRIDGE, VA 22193 USA

The banking and fintech industry is undergoing a digital revolution, where innovation meets precision. At Devsinc, we empower businesses with cutting-edge solutions, from secure payment gateways and mobile banking platforms to AI-driven analytics and blockchain integrations. Our expertise ensures seamless compliance with financial regulations, enhanced customer experiences, and optimized operations. By combining technical mastery with industry insight, we help banks and fintech leaders stay competitive, scalable, and secure in a fast-evolving landscape.

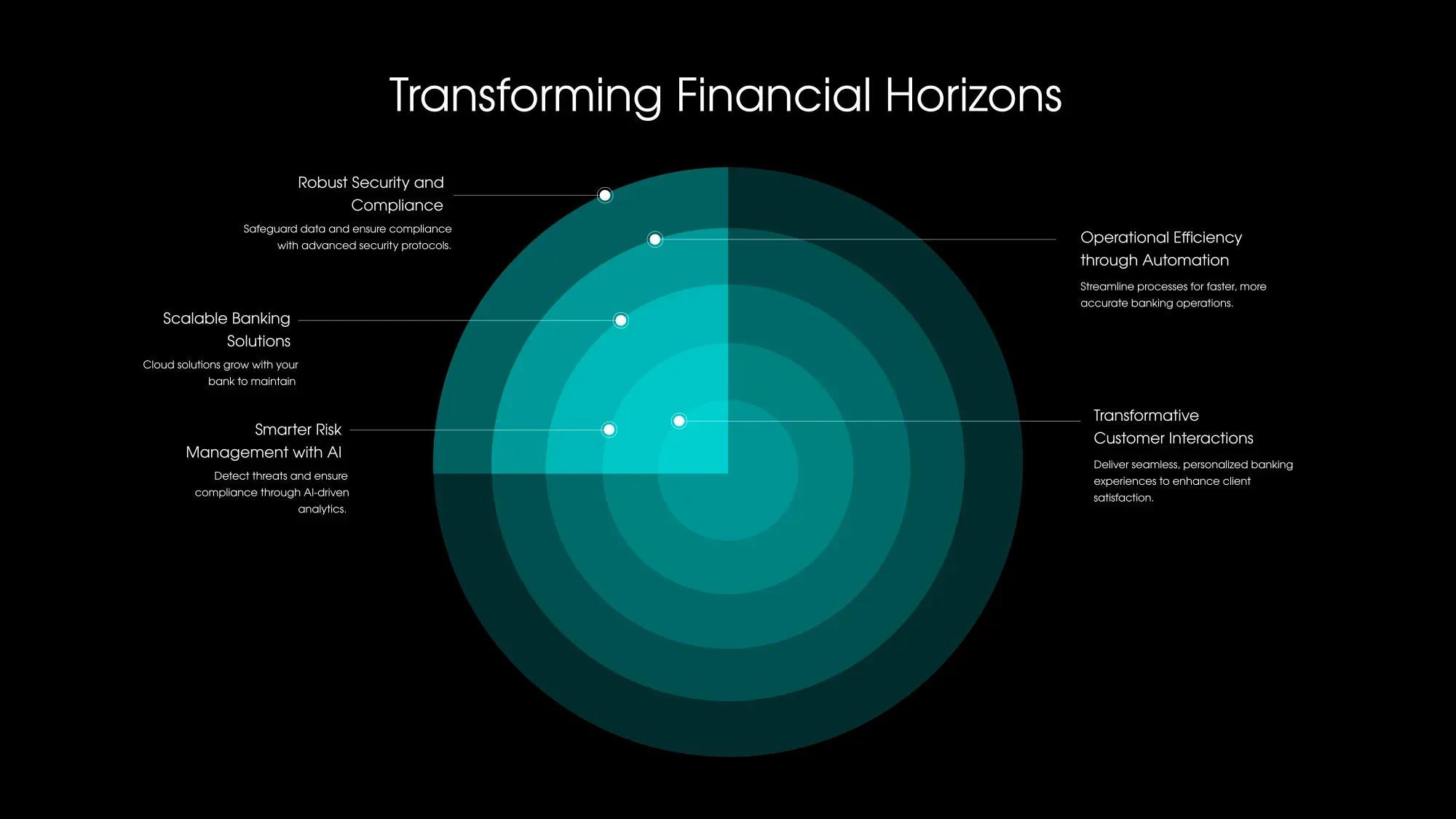

Techclomate understands the complexity of the financial landscape and the need for innovative solutions that address the industry’s critical challenges:

Design seamless, omnichannel banking experience, including advanced digital wallet integrations and Buy Now, Pay Later (BNPL) capabilities.

Integrate AI-driven analytics to support strategic decision-making and gain a competitive edge.

Streamline back-office operations with payment gateway solutions and KYC automation, reducing costs and boosting productivity.

Ensure your financial systems are resilient, secure, and fully compliant with eIDV (Electronic Identity Verification) and AISP requirements.

Enable secure, flexible digital banking with our suite of mobile banking applications, digital wallet functionalities, and API banking solutions. We create seamless, end-to-end digital experiences for the modern financial landscape.

Make informed, data-backed decisions with AI-driven analytics and Account Information Service Provider (AISP) integration. Our analytics solutions turn data into actionable insights, optimizing both customer-facing services and internal processes.

Protect sensitive Personally Identifiable Information (PII) with multi-layered cybersecurity measures, regulatory compliance checks, eIDV, and KYC automation to ensure robust identity verification and mitigate risks.

Our cloud-based services enhance scalability and resilience, helping you meet evolving regulatory and customer demands. We ensure secure, compliant cloud migrations designed for banking workloads.