Financial Services Technology Landscape

Financial institutions face increasing demands for precise information processing, crucial for

market performance, regulatory compliance, and client trust. The adoption of on-premises RAG

(Retrieval-Augmented Generation) solutions offers a transformative approach to managing complex

financial data and relationships.

Contemporary Challenges

Today’s financial entities grapple with massive data volumes, evolving regulations, and the need

for timely decision-making. Traditional information management often creates bottlenecks, leading to

delays and operational risks. Professionals spend 40-50% of their time gathering and analyzing data,

hampered by siloed systems that prevent holistic insights.

The RAG Solution

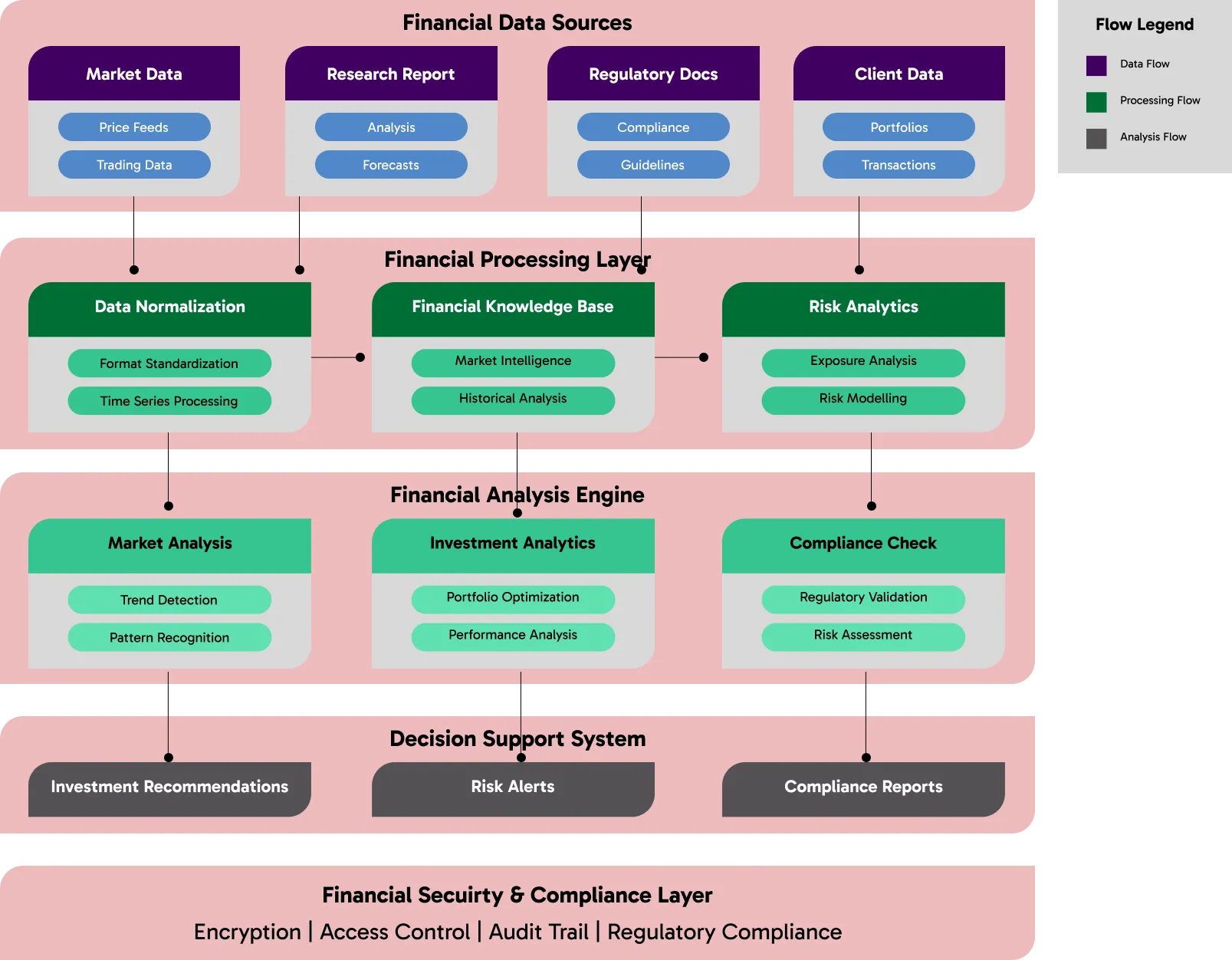

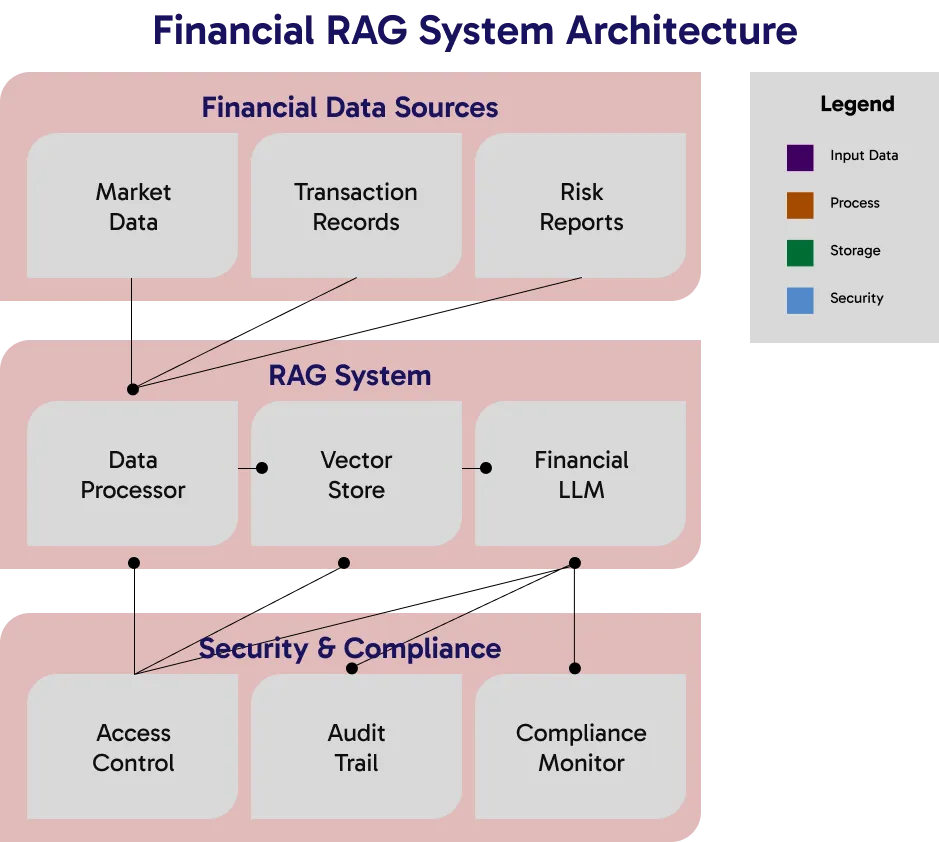

Implementing an on-premises RAG system transforms financial information processing. It integrates

seamlessly with existing infrastructures, processing both structured and unstructured data while

ensuring security and compliance.

Key Benefits

- Efficiency: Market analysis time reduced by 65%.

- Accuracy: Risk assessment improved by 50%.

- Compliance: Regulatory checks take 70% less time.

- Client Service: Response times to queries improved by 45%.

Future-Ready Operations

The RAG system positions financial institutions for growth, enabling them to adapt to complex

markets and stringent regulations while continually enhancing their capabilities.